- EigenLayer’s handle development highlighted surging adoption with a 148.61% hike in new addresses

- Market sentiment stabilized as improvement exercise and MVRV ratios pointed to balanced buying and selling dynamics

Within the dynamic blockchain house, EigenLayer [EIGEN] has seen spectacular community development, signaling its rising prominence amongst Ethereum staking options. In reality, over the previous week alone, the platform has recorded a surge in new addresses, energetic accounts, and total person engagement.

These developments, collectively, spotlight better curiosity in EigenLayer’s choices, making it a standout performer within the Ethereum ecosystem. At press time, EIGEN was buying and selling at $3.69, following a slight 1.66% decline within the final 24 hours.

EIGEN handle development exhibits increasing community exercise

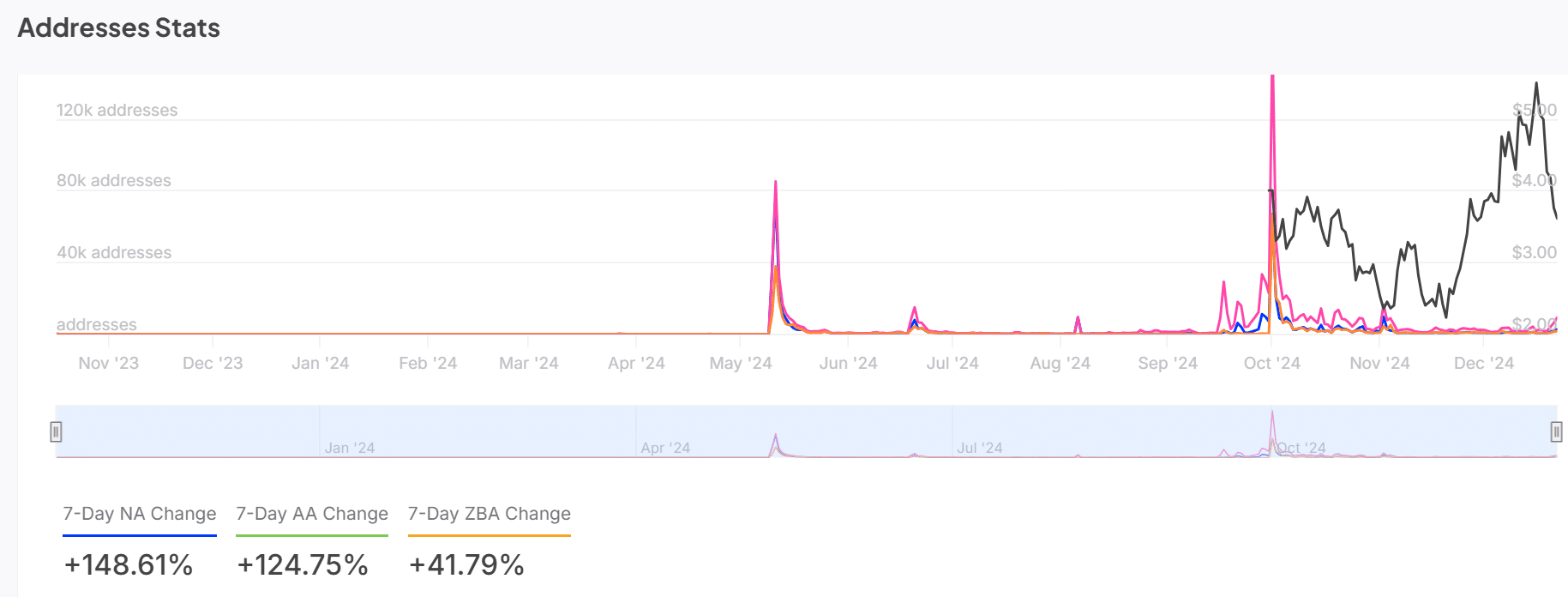

EigenLayer’s handle statistics highlighted a community noting fast development and engagement. The 148.61% surge in new addresses mirrored an inflow of contemporary individuals, drawn to the platform’s revolutionary staking options.

Moreover, the 124.75% uptick in energetic addresses underlined sustained exercise amongst present customers – An indication of sturdy retention. In the meantime, the 41.79% enhance in zero-balance accounts pointed to rising curiosity from potential traders exploring the platform.

These mixed metrics may be seen to allude to EigenLayer’s increasing footprint within the Ethereum staking ecosystem.

A balanced market sentiment?

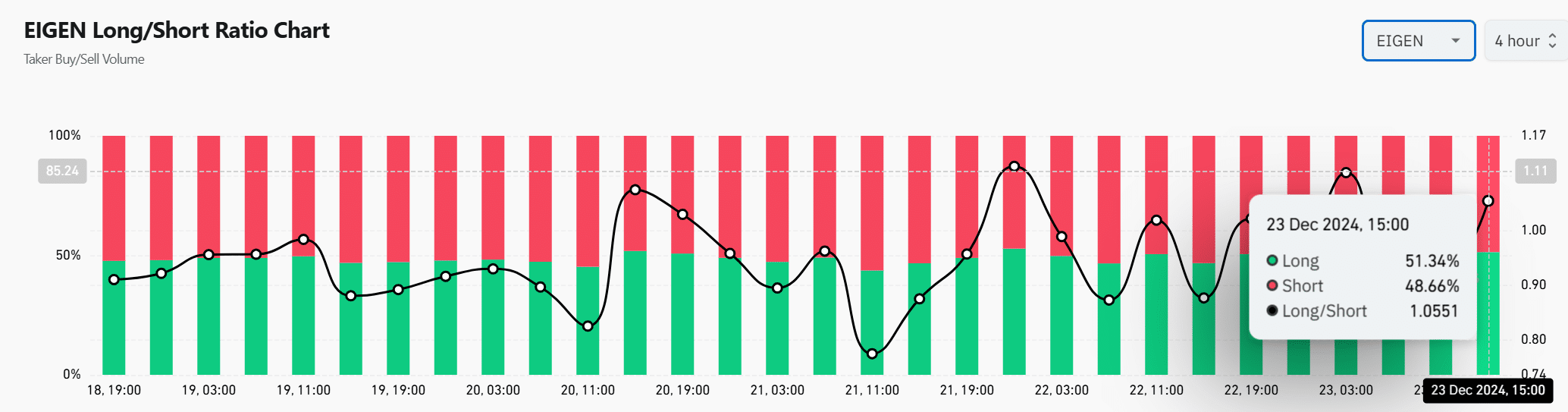

The market sentiment for EIGEN has remained pretty well-balanced, because the lengthy/brief ratio indicated a near-equal break up. On the time of writing, 51.34% of positions had been lengthy, with 48.66% brief – Underlining a cautious but optimistic outlook amongst merchants.

Current spikes in lengthy positions signaled that some traders are betting on a possible worth restoration, regardless of its current volatility.

This steadiness urged a market that’s rigorously weighing dangers and alternatives, with no excessive bias in the direction of both aspect. Such sentiment typically precedes vital strikes, making this a vital space to look at.

Regular improvement exercise reinforces innovation

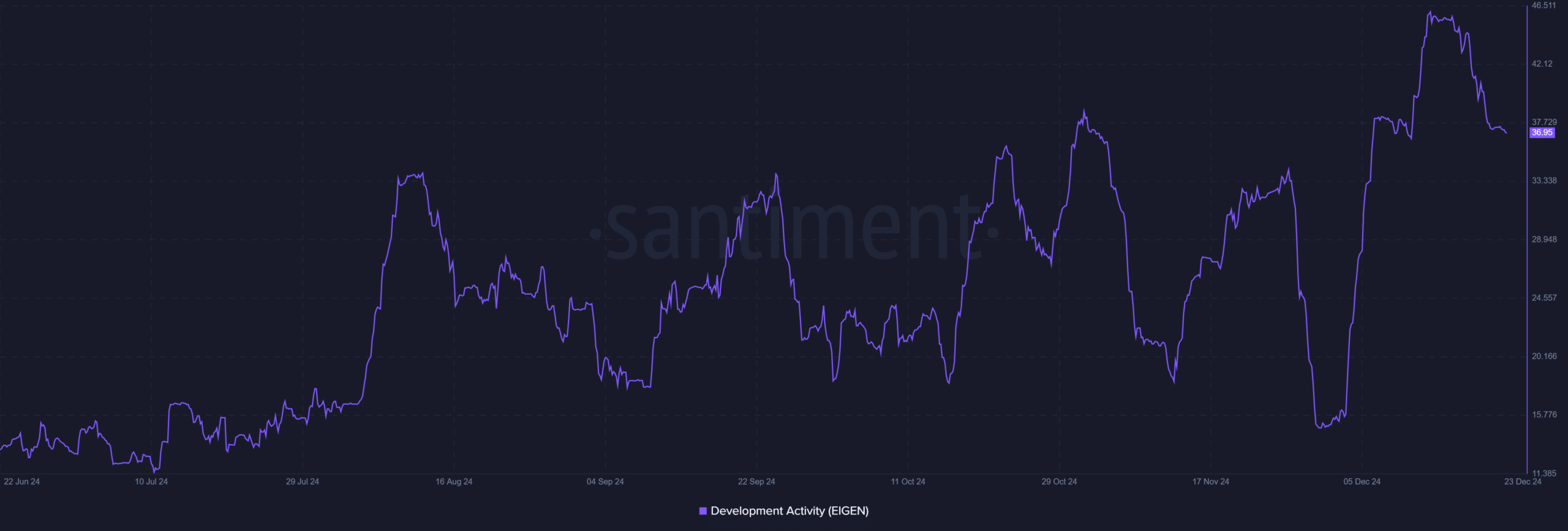

Improvement exercise on EigenLayer has maintained a gentle tempo, with a press time rating of 36.95. Whereas not at its peak, this degree of exercise is an indication of steady enhancements and enhancements to the platform.

Common updates and improvements reassure customers and traders of the mission’s long-term dedication to staying aggressive. Due to this fact, EigenLayer’s constant improvement efforts present a stable basis for sustained development within the Ethereum staking house.

MVRV ratio indicators potential for profit-taking

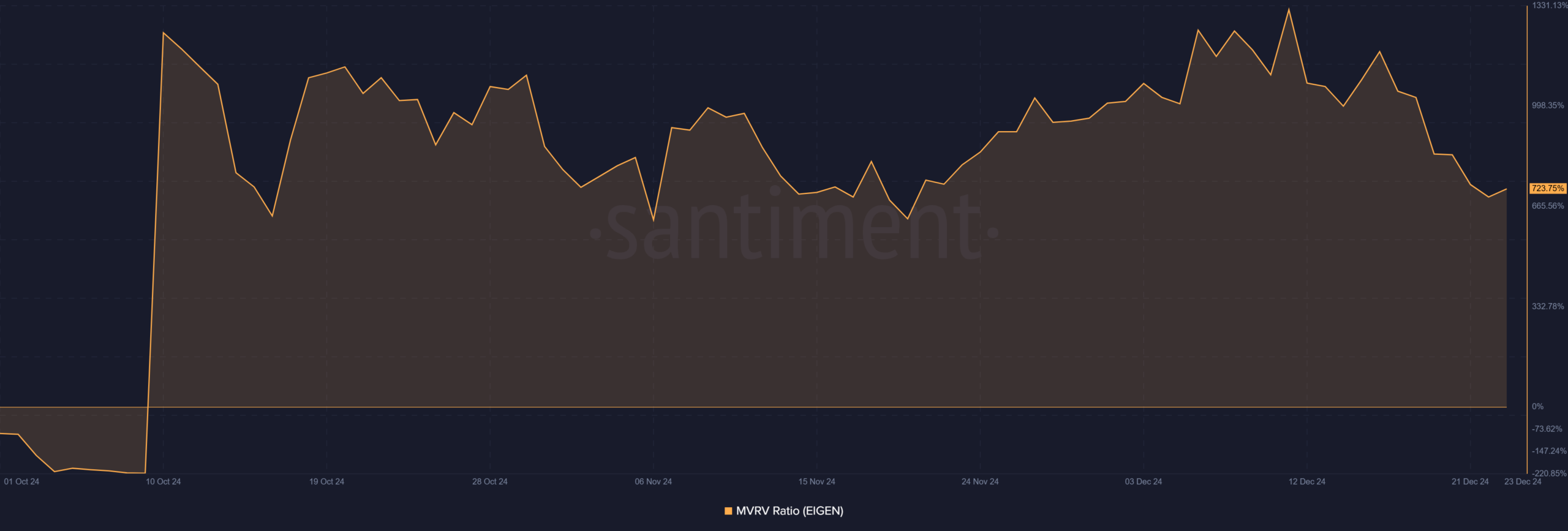

The MVRV ratio, standing at 723.75%, urged that many early adopters have had vital unrealized features. Elevated MVRV ranges typically coincide with better profit-taking, which might end in short-term volatility.

Nonetheless, such exercise may current a possibility for brand spanking new traders to enter at lower cost factors. This dynamic between profit-taking and contemporary shopping for might create an attention-grabbing worth motion sample within the coming days.

Potential for restoration?

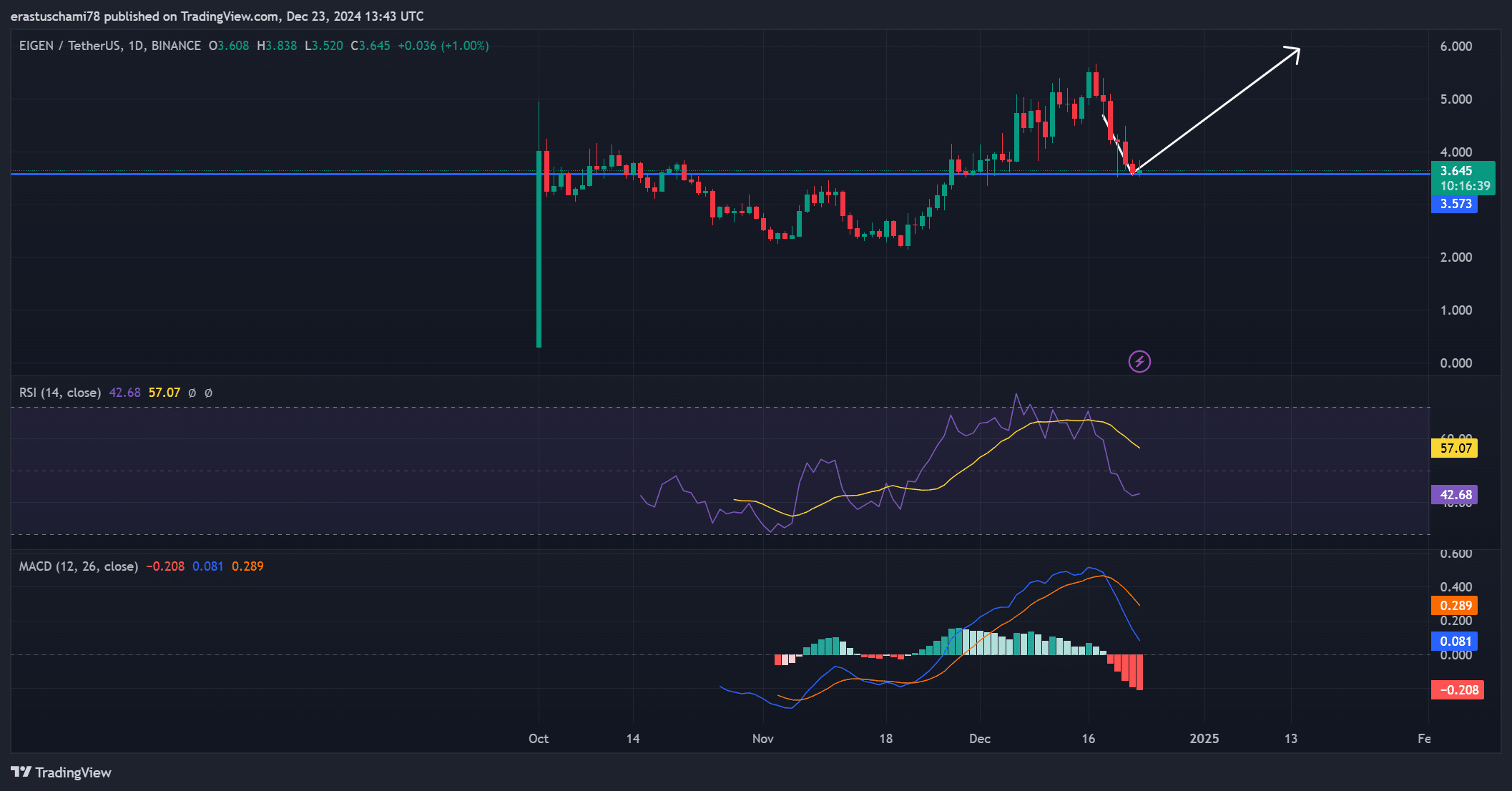

Technical evaluation flashed blended indicators for EIGEN’s near-term worth trajectory. As an illustration – The RSI at 42.68 urged that the token could also be nearing oversold territory, which regularly precedes a bounce.

In the meantime, the MACD indicated delicate bearish momentum, with a price of -0.208. Nonetheless, with sturdy help close to $3.57, EIGEN has the potential to stabilize and get better if bullish sentiment strengthens itself. Due to this fact, a reversal in market sentiment might pave the way in which for renewed upward momentum.

Is your portfolio inexperienced? Try the EIGEN Profit Calculator

EigenLayer’s sturdy handle stats, balanced market sentiment, and constant improvement exercise underscore its rising relevance in Ethereum staking. Whereas short-term worth challenges stay, the platform’s spectacular metrics entail it’s well-positioned for sustained development.