Bitcoin’s worth retracement from its new all-time excessive of $108,353 on Tuesday to round $96,000 (a -11.5% pullback) has ignited intense hypothesis about whether or not the present bull cycle is nearing its peak. To handle rising uncertainty, Rafael Schultze-Kraft, co-founder of on-chain analytics supplier Glassnode, released a thread on X detailing 18 on-chain metrics and fashions. “The place is the Bitcoin TOP?” Schultze-Kraft requested, earlier than laying out his detailed evaluation.

Has Bitcoin Reached Its Cycle Prime?

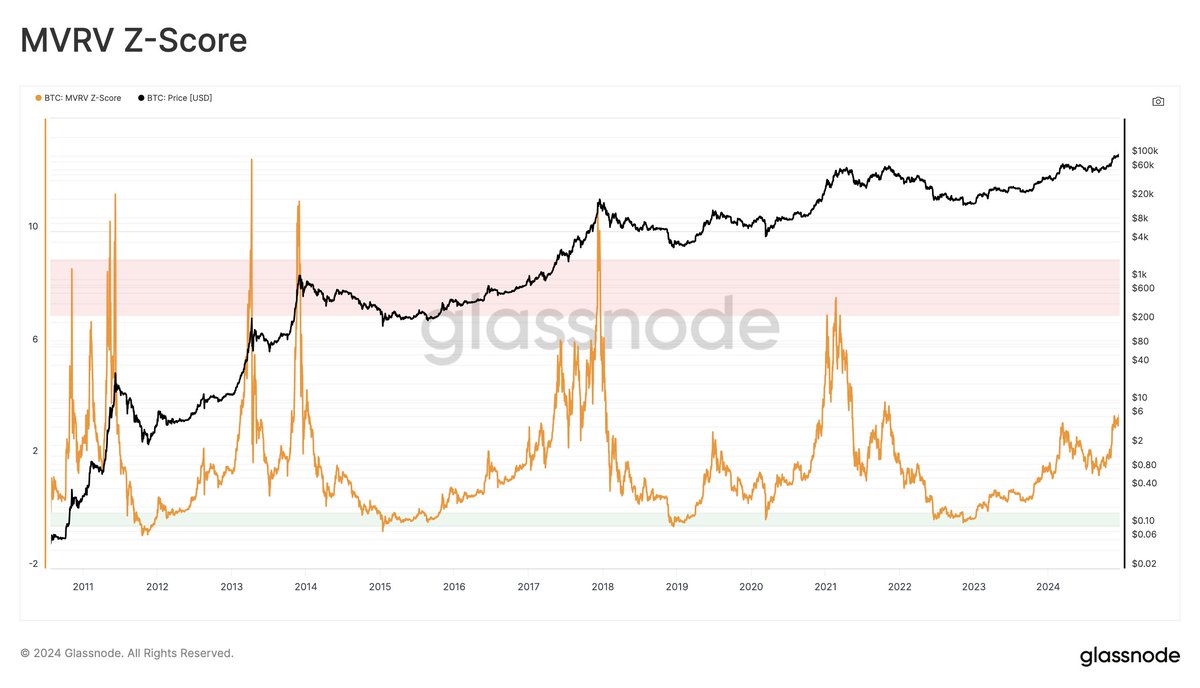

1/ MVRV Ratio: A longstanding measure of unrealized profitability, the MVRV ratio compares market worth to realized worth. Traditionally, readings above 7 signaled overheated circumstances. “At present hovering round 3 – room to develop,” Schultze-Kraft famous. This means that, by way of mixture unrealized revenue, the market shouldn’t be but at ranges which have beforehand coincided with macro tops.

2/ MVRV Pricing Bands: These bands are derived from the variety of days MVRV has spent at excessive ranges. The highest band (3.2) has been exceeded for less than about 6% of buying and selling days traditionally. As we speak, this prime band corresponds to a worth of $127,000. Provided that Bitcoin sits at round $98,000, the market has not but reached a zone that traditionally marked prime formations.

3/ Lengthy-Time period Holder Profitability (Relative Unrealized Revenue & LTH-NUPL): Lengthy-term holders (LTHs) are thought of extra steady market contributors. Their Internet Unrealized Revenue/Loss (NUPL) metric is at present at 0.75, coming into what Schultze-Kraft phrases the “euphoria zone.” He remarked that within the 2021 cycle, Bitcoin ran one other ~3x after hitting related ranges (although he clarified he’s not essentially anticipating a repetition). Historic prime formations usually noticed LTH-NUPL readings above 0.9. Thus, whereas the metric is elevated, it has not but reached earlier cycle extremes.

Notably, Schultze-Kraft admitted his observations could also be conservative as a result of the 2021 cycle peaked at considerably decrease profitability values than prior cycles. “I’d’ve anticipated these profitability metrics to achieve barely greater ranges,” he defined. This may increasingly sign diminishing peaks over successive cycles. Traders must be conscious that historic extremes could change into much less pronounced over time.

4/ Yearly Realized Revenue/Loss Ratio: This metric measures the overall realized income relative to realized losses over the previous yr. Earlier cycle tops have seen values above 700%. At present at round 580%, it nonetheless reveals “room to develop” earlier than reaching ranges traditionally related to market tops.

Associated Studying

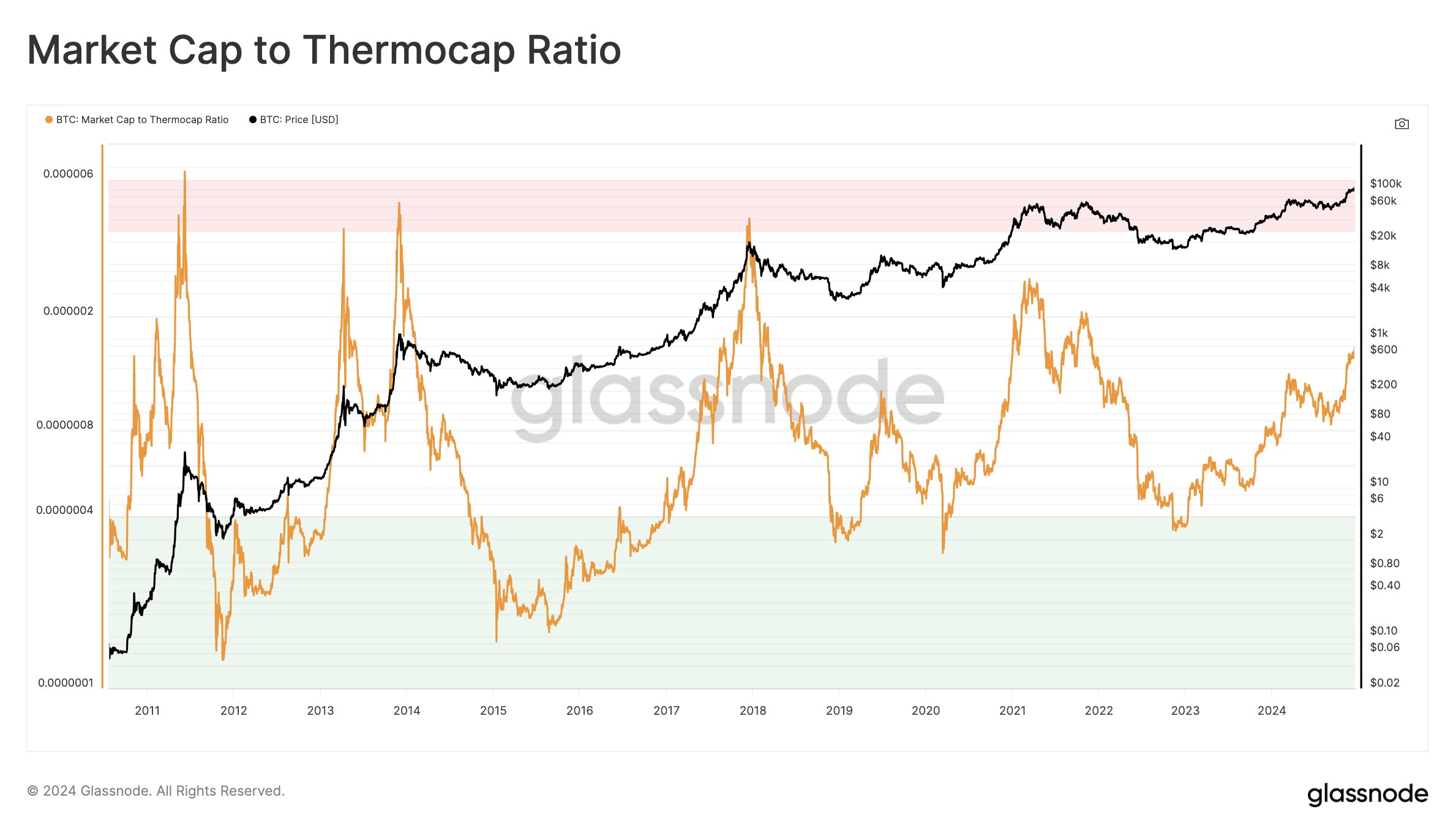

5/ Market Cap To Thermocap Ratio: An early on-chain metric, it compares Bitcoin’s whole market capitalization to the cumulative mining value (Thermocap). In prior bull runs, the ratio’s extremes aligned with market tops. Schultze-Kraft advises warning with particular goal ranges however notes that present ranges will not be near earlier extremes. The market stays beneath historic thermocap multiples that indicated overheated circumstances up to now.

6/ Thermocap Multiples (32-64x): Traditionally, Bitcoin has topped at roughly 32-64 occasions the Thermocap. “We’re on the backside of this vary,” mentioned Schultze-Kraft. Hitting the highest band in at the moment’s setting would suggest a Bitcoin market cap simply above $4 trillion. Provided that present market capitalization ($1.924 trillion) is considerably decrease, this implies the potential of substantial upside if historic patterns have been to carry.

7/ The Investor Device (2-12 months SMA x5): The Investor Device applies a 2-year Easy Transferring Common (SMA) of worth and a 5x a number of of that SMA to sign potential prime zones. “Which at present denotes $230,000,” Schultze-Kraft famous. Since Bitcoin’s present worth is effectively beneath this stage, the indicator has not but flashed an unequivocal prime sign.

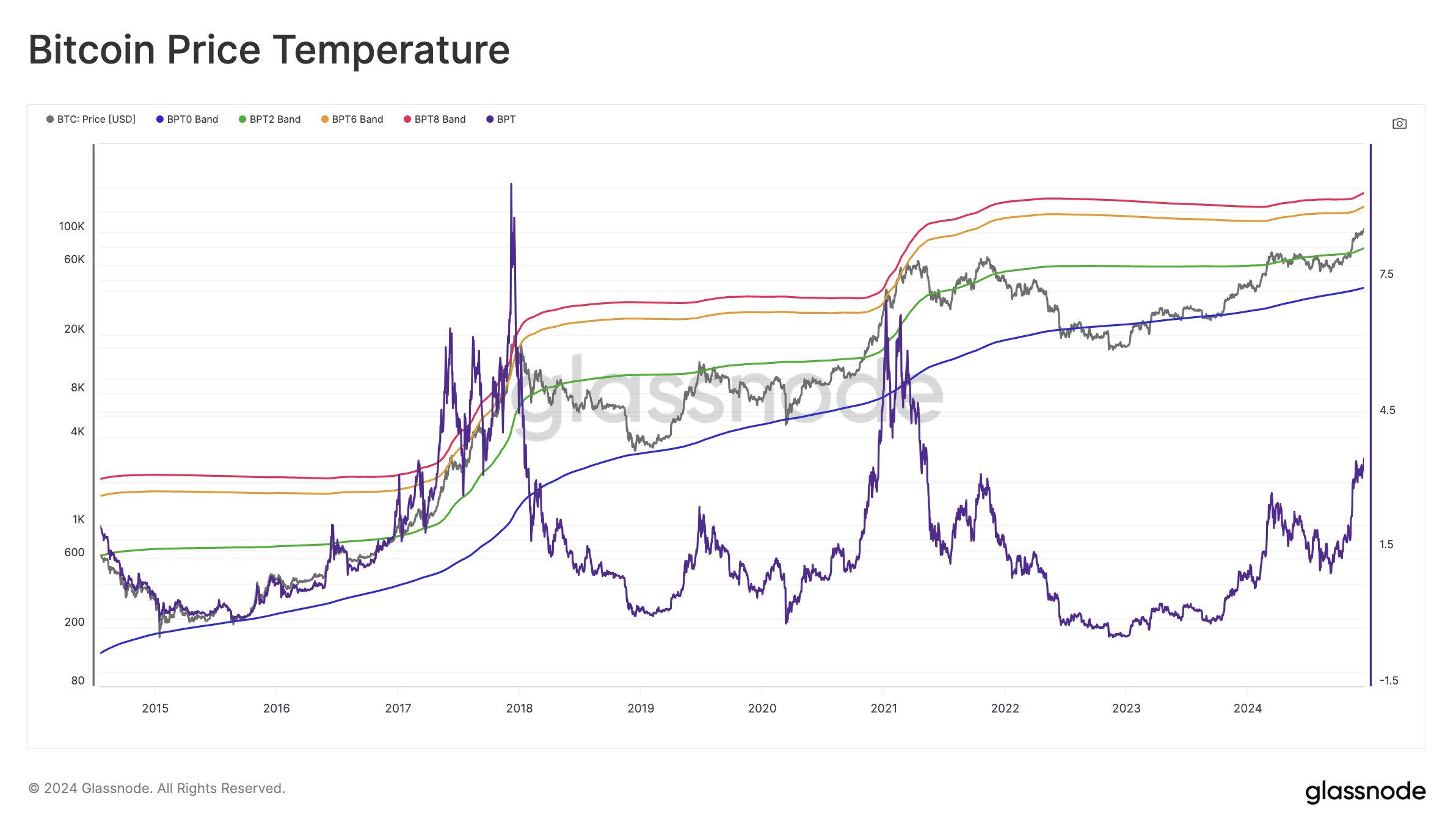

8/ Bitcoin Worth Temperature (BPT6): This mannequin makes use of deviations from a 4-year shifting common to seize cyclical worth extremes. Traditionally, BPT6 was reached in earlier bull markets, and that band now sits at $151,000. With Bitcoin at $98,000, the market remains to be wanting ranges beforehand related to peak overheating.

9/ The True Market Imply & AVIV: The True Market Imply is an alternate value foundation mannequin. Its MVRV-equivalent, referred to as AVIV, measures how far the market strays from this imply. Traditionally, tops have seen greater than 3 customary deviations. As we speak’s equal “quantities to values above ~2.3,” whereas the present studying is 1.7. “Room to develop,” Schultze-Kraft mentioned, implying that by this metric, the market shouldn’t be but stretched to its historic extremes.

Associated Studying

10/ Low/Mid/Prime Cap Fashions (Delta Cap Derivatives): These fashions, primarily based on the Delta Cap metric, traditionally confirmed diminished values throughout the 2021 cycle, by no means reaching the ‘Prime Cap.’ Schultze-Kraft urges warning in deciphering these on account of evolving market constructions. At present, the mid cap stage sits at about $4 trillion, roughly a 2x from present ranges. If the market adopted earlier patterns, this might permit for appreciable development earlier than hitting ranges attribute of earlier tops.

11/ Worth Days Destroyed A number of (VDDM): This metric gauges the spending habits of long-held cash relative to the annual common. Traditionally, excessive values above 2.9 indicated that older cash have been closely hitting the market, usually throughout late-stage bull markets. Presently, it’s at 2.2, not but at excessive ranges. “Room to develop,” Schultze-Kraft famous, suggesting not all long-term holders have totally capitulated to profit-taking.

12/ The Mayer A number of: The Mayer Multiple compares worth to the 200-day SMA. Overbought circumstances in earlier cycles aligned with values above 2.4. At present, a Mayer A number of above 2.4 would correspond to a worth of roughly $167,000. With Bitcoin underneath $100,000, this threshold stays distant.

13/ The Cycle Extremes Oscillator Chart: This composite makes use of a number of binary indicators (MVRV, aSOPR, Puell A number of, Reserve Danger) to sign cycle extremes. “At present 2/4 are on,” that means solely half of the tracked circumstances for an overheated market are met. Earlier tops aligned with a full suite of triggered indicators. As such, the chart suggests the cycle has not but reached the depth of a full-blown peak.

14/ Pi Cycle Top Indicator: A price-based sign that has traditionally recognized cycle peaks by evaluating the short-term and long-term shifting averages. “At present the quick shifting common sits effectively beneath the bigger ($74k vs. $129k),” Schultze-Kraft mentioned, indicating no crossover and thus no basic prime sign.

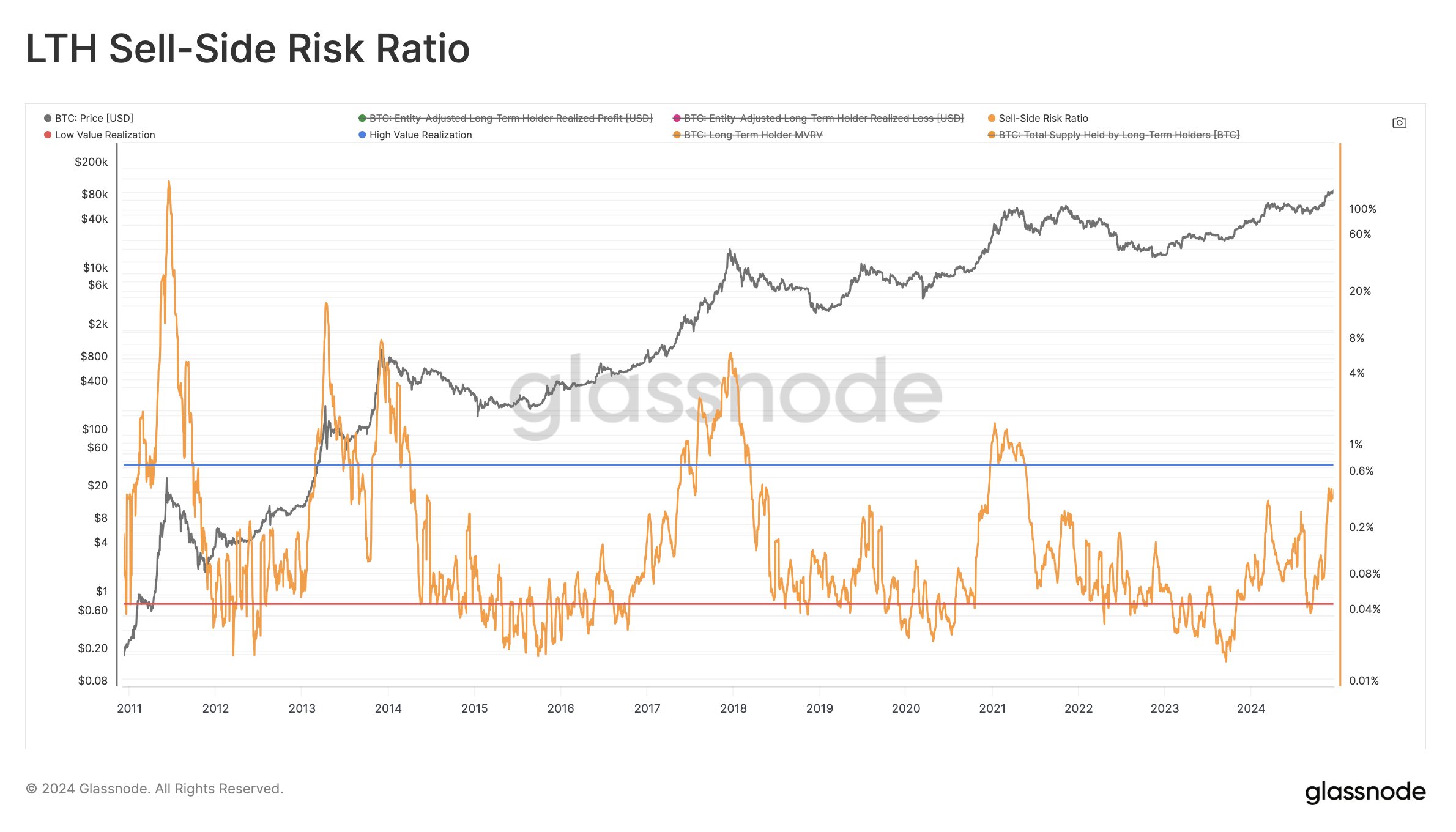

15/ Promote-Aspect Danger Ratio (LTH Model): This ratio compares whole realized income and losses to the realized market capitalization. Excessive values correlate with risky, late-stage bull markets. “The attention-grabbing zone is at 0.8% and above, whereas we’re at present at 0.46% – room to develop,” Schultze-Kraft defined. This suggests that, regardless of current profit-taking, the market has not but entered the extreme promote strain zone usually seen close to tops.

16/ LTH Inflation Price: Schultze-Kraft highlighted the Lengthy-Time period Holder Inflation Price as “probably the most bearish chart I’ve come throughout up to now.” Whereas he didn’t present particular goal values or thresholds on this excerpt, he acknowledged it “screams warning.” Traders ought to monitor this carefully as it could sign growing distribution from long-term holders or different structural headwinds.

17/ STH-SOPR (Brief-Time period Holder Spent Output Revenue Ratio): This metric measures the profit-taking habits of short-term holders. “At present elevated, however not sustained,” Schultze-Kraft famous. In different phrases, whereas short-term contributors are taking income, the information doesn’t but present the form of persistent, aggressive profit-taking typical of a market prime.

18/ SLRV Ribbons: These ribbons observe developments in short- and long-term realized worth. Traditionally, when each shifting averages prime out and cross over, it signifies a market turning level. “Each shifting averages nonetheless trending up, solely turns into bearish at rounded tops and crossover. No indication of a prime at the moment,” Schultze-Kraft acknowledged.

Total, Schultze-Kraft emphasised that these metrics shouldn’t be utilized in isolation. “By no means depend on single knowledge factors – confluence is your good friend,” he suggested. He acknowledged that it is a non-comprehensive checklist and that Bitcoin’s evolving ecosystem—now with ETFs, regulatory readability, institutional adoption, and geopolitical components—could render historic comparisons much less dependable. “This cycle can look vastly completely different, but (historic) knowledge is all we’ve,” he concluded.

Whereas quite a few metrics present that Bitcoin’s market is shifting into extra euphoric and worthwhile territory, few have reached the historic extremes that marked earlier cycle tops. Indicators like MVRV, profitability ratios, thermal metrics, and varied price-based fashions usually recommend “room to develop,” though no less than one—LTH Inflation Price—raises a word of warning. Some composites are solely partially triggered, whereas basic prime indicators reminiscent of Pi Cycle Prime stay inactive.

At press time, BTC traded at $96,037.

Featured picture created with DALL.E, chart from TradingView.com